Yesterday, AWS lobbed a bit of a water balloon into my inbox. Specifically, they’ve made a change to the AWS Marketplace that was announced to AWS Marketplace seller accounts, but it doesn’t seem any customers have been notified of this new development.

Here’s the email:

The FAQ document they link to is available here, though it has changed since the email was sent. Here’s a link to the original, which contains some additional information.

What’s Changing?

Purchases on AWS Marketplace count toward contractual spend commitments (commonly referred to as “spend retirement” or “commitment retirement”), with some exceptions.

For contracts signed prior to 2022, 50% of Marketplace spend by dollar amount counted toward the commitment, with limited exceptions. The terms changed beginning in 2022 to count 100% of spend, but with a cap at 25% of the annual commitment (a good change!), exclude Professional Services from counting toward commitment retirement, and add a small piece of language—that seemed innocuous until now—that refers to what counts for commitment retirement: “… fees for purchases on AWS Marketplace that are deployed on [AWS services]”.

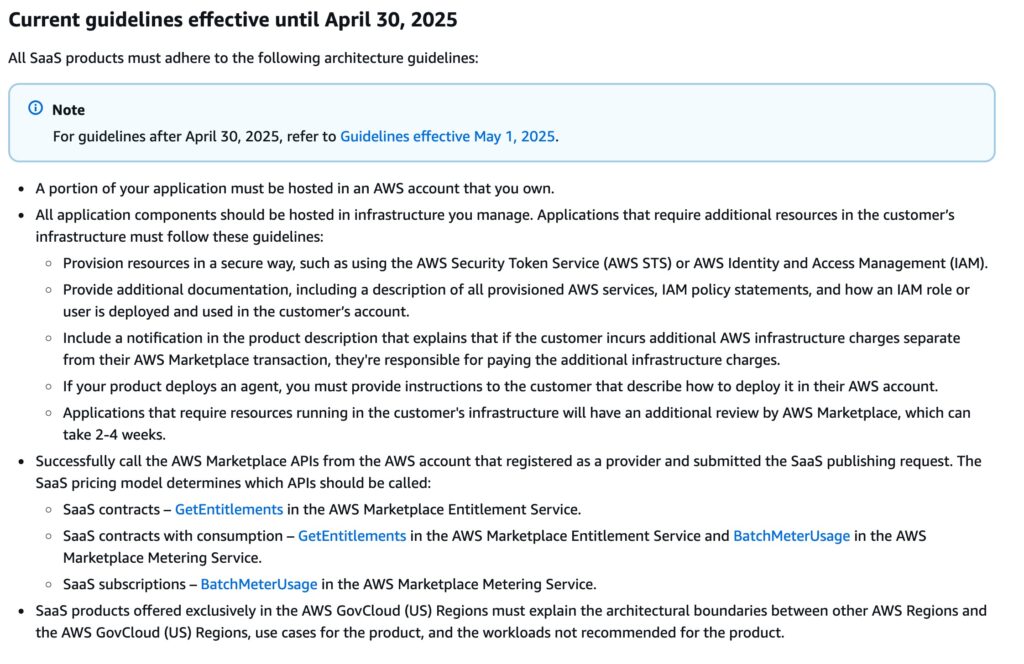

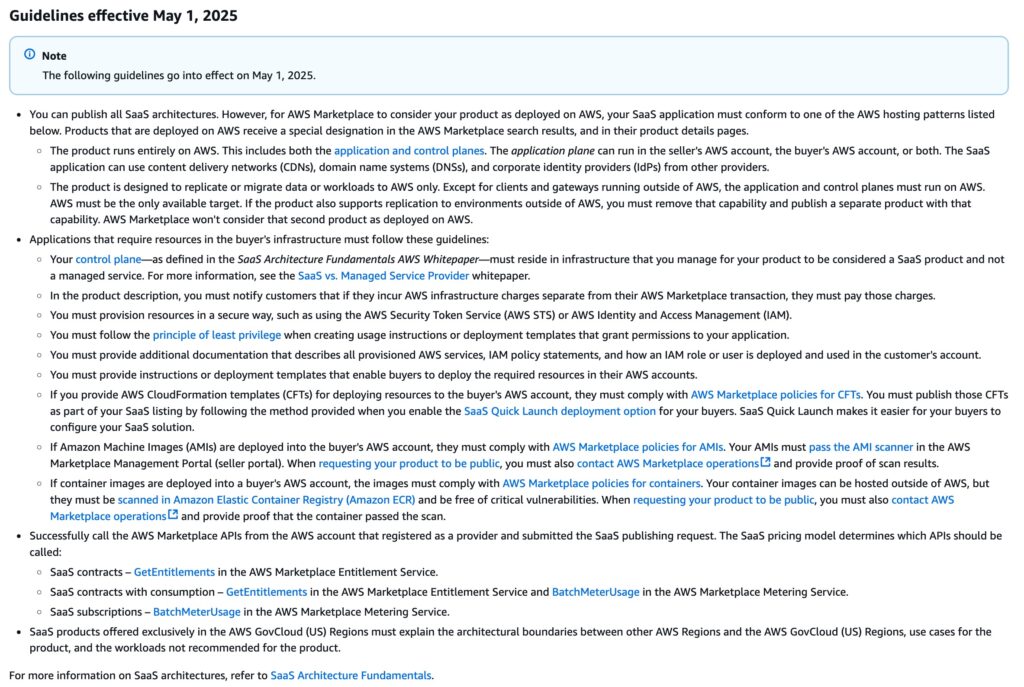

Starting May 1st, 2025, only SaaS products hosted entirely on AWS will qualify for commitment retirement, effectively enforcing the above clause customers began agreeing to three years ago. This represents a dramatic shift from the previous requirement, which only specified that “a portion of your application must be hosted in an AWS account that you own.”

If your product is focused on facilitating workload migrations to AWS, the product must, in order to qualify, pass this section:

The product is specifically designed to collect data, replicate data, or migrate workloads from outside AWS to AWS. Except for clients and gateways running outside of AWS, the application and control planes must run on AWS. AWS must be the only available target. If the product also supports replication to environments outside of AWS, you must remove that capability and publish a separate product with that capability. AWS Marketplace won’t consider that second product as deployed on AWS.

What does this mean for customers?

Any customer who relies on Marketplace to help meet their spend commitments now has to be concerned that their SaaS vendors are running entirely in AWS. On the plus side, AWS is providing a mechanism for vendors to get that approval, which will make it easier on the customer, but it is another thing a customer has to think about. No longer can a customer be assured that any vendor spend will count toward their commitment. (And to be clear, AWS isn’t preventing customers from purchasing non-qualifying products via Marketplace, but they won’t count toward commitment retirement.)

More annoyingly is that AWS does not provide mechanisms for customers to track their commitment retirement and, at the time of this writing, does not provide a mechanism to see which purchases in AWS Marketplace are or not eligible (though this is planned to release before May 1, 2025, as mentioned above) (Update on May 5, 2025: AWS now provides a Deployed on AWS badge for Marketplace to identify which purchases are eligible for commitment retirement), so this change does introduce more uncertainty for the customer.

What does this mean for AWS ISV/SaaS Partners?

Yet more hoops to jump through and requirements to meet, unfortunately. It’s been a long-standing complaint from AWS ISV partners that the requirements can be excessive and it seems they just got a little bit more onerous.

One thing that stands out to me are ISVs who operate in multiple providers, allowing the customer to choose which provider the workload lives in—it’s unclear how these will be handled under the new rules. Likewise, it’s also not clear how ISVs who run concurrently in multiple providers for resiliency reasons will be handled in this new change.

Both Azure and Google Cloud have similar policies. Azure’s MACC program requires products to be “primarily platformed on Azure”, but does not restrict whether a product in Azure Marketplace operates on Azure (the same policy as AWS now), while Google Cloud’s is actually more restrictive: the product must operate on Google Cloud to even be listed in Google Cloud Marketplace.

When we asked AWS for comment on this article prior to publishing, they suggested it’s common for SaaS products to run provider-specific environments for this purpose, though our spot-checks of common SaaS products seems to indicate this is only common for the largest of SaaS companies (eg, Dynatrace, Wiz—both of which are available in the Google Cloud Marketplace) with smaller companies operating exclusively in AWS (eg, PagerDuty, Arctic Wolf, Honeycomb—none of which are even available in the Google Cloud Marketplace).

It’s also worth noting that all of the cloud providers give deeper private pricing discounts for increased commitments, and so vendors splitting their consumption across multiple clouds under these policies will decrease the discounts they could obtain. And, thus, AWS benefits here more than Azure and Google Cloud by forcing vendors to weigh the tradeoffs on splitting their environment up.

The current and new guidelines are available in the AWS Marketplace Seller Guide, with screenshots below for posterity.

What might this mean for AWS Services Partners in the future?

While not explicitly covered in this update, these changes did cause me to think about AWS Services partners (such as ourselves).

The Duckbill Group’s presence on the AWS Marketplace (and the reason I got this email at all) stems from customer requests to facilitate their procurement process by paying for our services through the AWS Marketplace. While this change doesn’t impact us, it raises questions about future restrictions. For example, could similar policies eventually impact Professional Services Marketplace spend unless vendors agree to certain requirements (such as not mentioning AWS’s cloud competitors in their marketing)?

And that “Professional Services” angle is why I find myself digging into the meat of this change. We spend a fair bit of time helping customers negotiate their AWS contracts, and for a while now we’ve seen Marketplace spend take a meaningful place in their future spend calculations, often with AWS pushing for it.

In fact, according to Forrester research in 2023 (commissioned by AWS!), Forrester found a common reason customers transact through Marketplace is to help with commitment retirement and that customers are increasing the commitments they’re making to AWS with Marketplace in mind (which is something I can confirm in our work supporting AWS contract negotiations). AWS further provides a lot of incentives for AWS Partners to transact with customers via the Marketplace. While Professional Services fees don’t count toward commitment retirement, it does make me wonder what happens in the future, now that it’s clear AWS is making changes that only benefit itself.

Where’s the “Customer Obsession”?

Which brings me to my main concern: these changes don’t seem to benefit customers or partners—only AWS. And they do so by requiring the partner to be running entirely on AWS—and not on a competitor’s cloud—or else the customer doesn’t benefit from using the Marketplace. No customers benefit from these new rules and, in fact, they’re somewhat worse off than they were prior to this.

If the ISV partners either have capabilities that go against the new rules or otherwise decline to submit new architectural diagrams to AWS, customers could suddenly lose out on millions in commitment retirement benefits mid-contract cycle.

I can see this from AWS’s perspective: why should non-AWS spend count toward commitment retirement, if they’re not benefitting from the vendor’s spend?

But man, how short-sighted and money-grabbing that is! AWS is already making money on the Marketplace transaction fees (which range from 1.5% to 3%, or a staggering 20% for AMIs) for simply being a broker, so why are these new restrictions even necessary? To me, it’s entirely a way to gain additional points on their margin without raising public prices—and that’s just unfortunate.